Unified Banking for Crypto, Fiat & Cards

Built for crypto‑driven operations

We give companies EU IBANs, multi‑asset wallets and corporate Mastercards in no time – no legacy banks, no patch‑work setups.

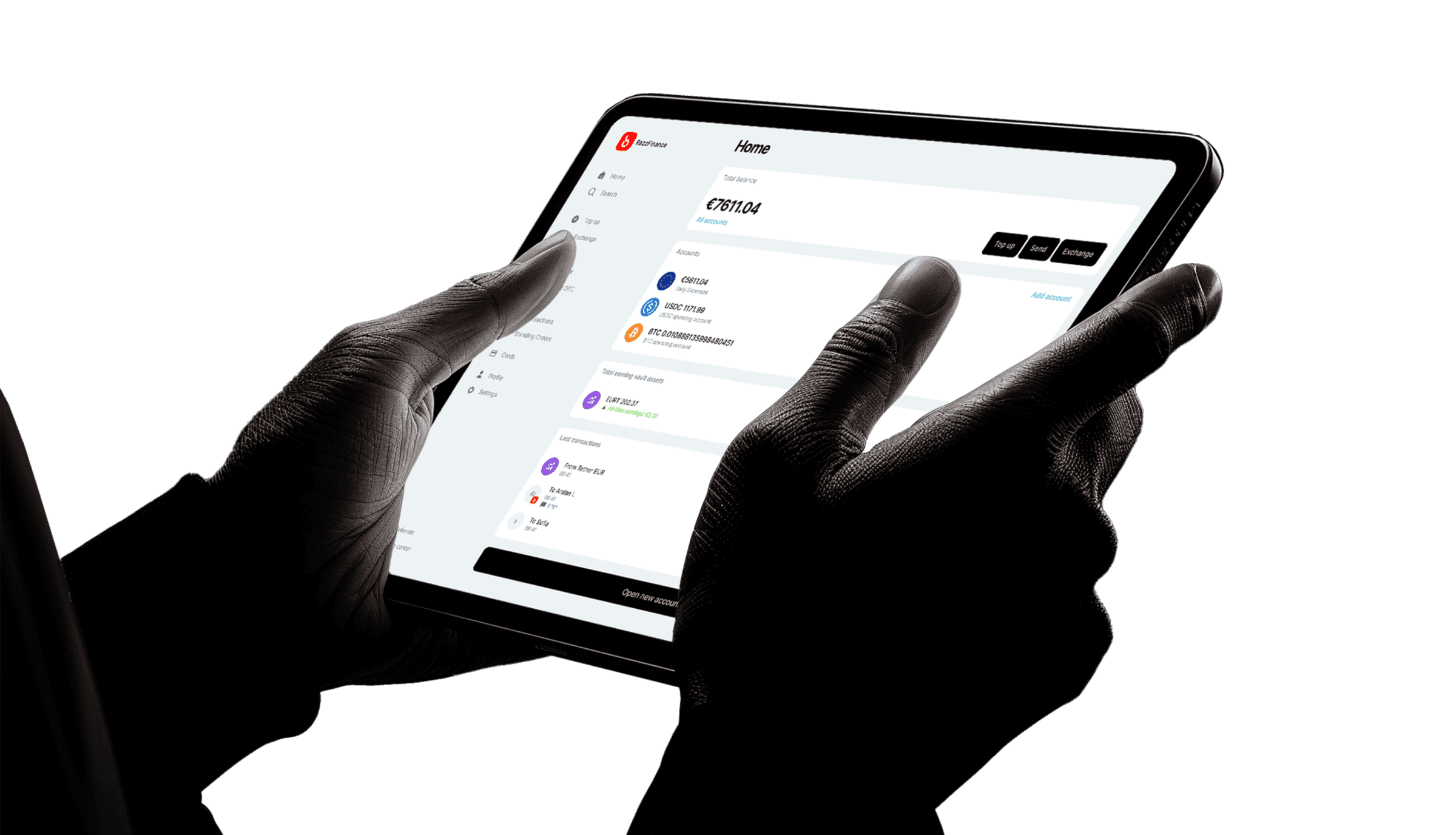

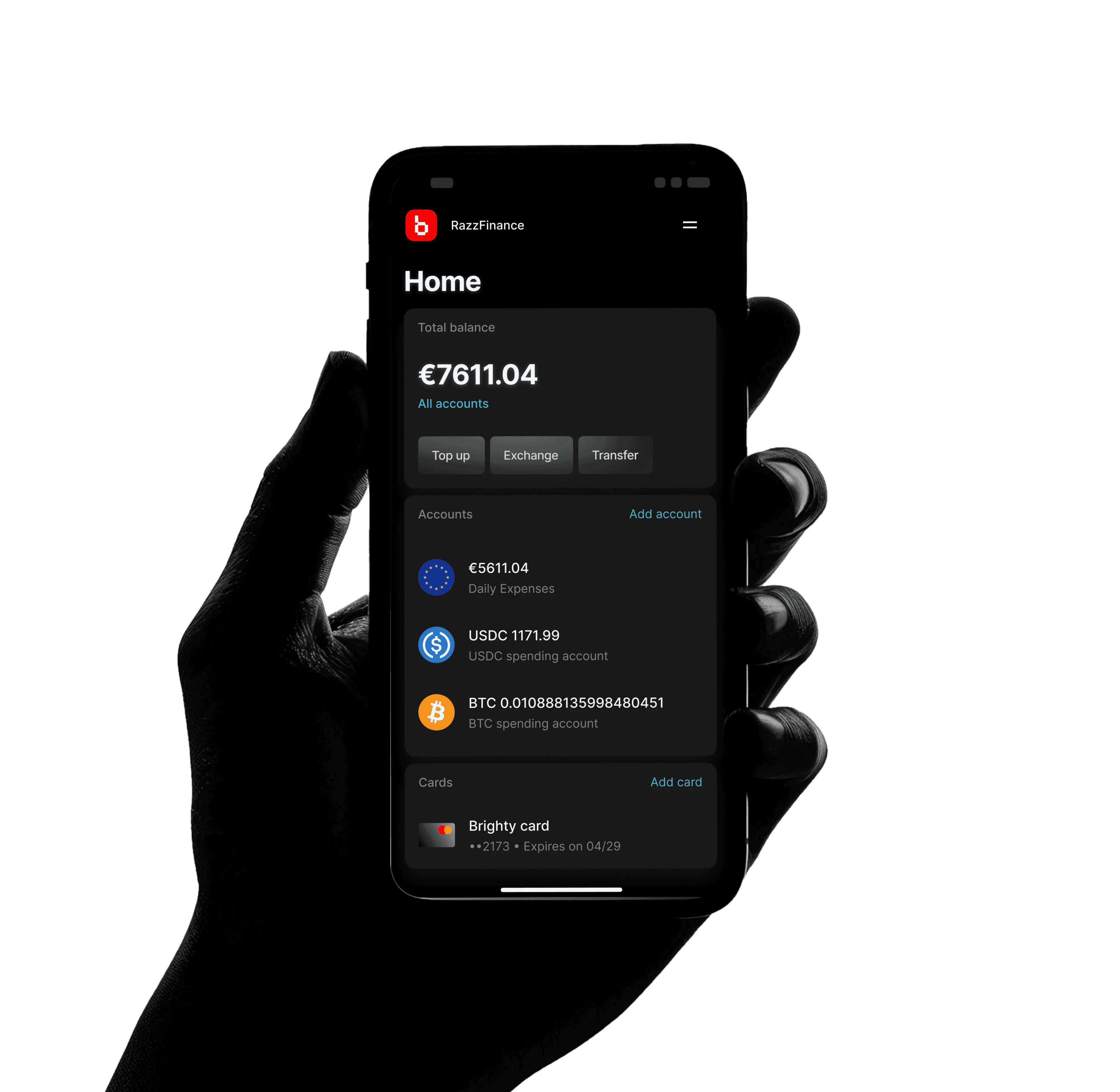

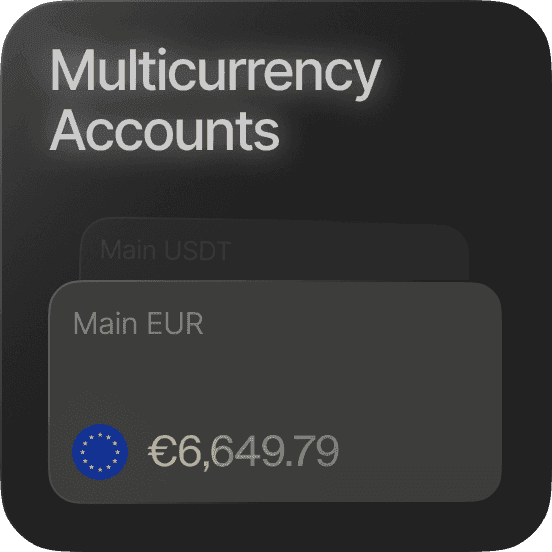

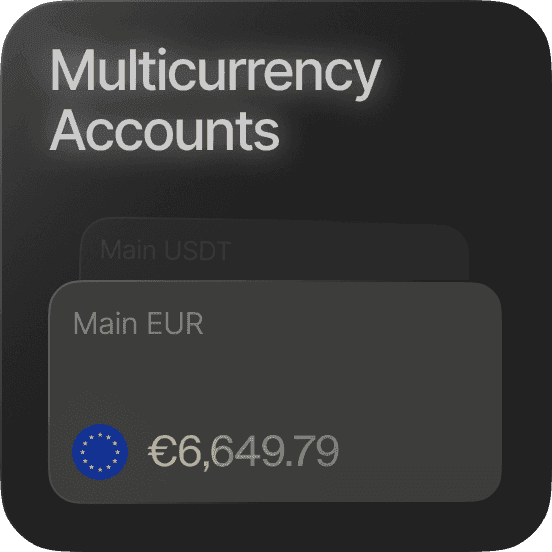

Crypto, Fiat & Cards managed from one dashboard

EU IBANs, multi‑chain wallets and corporate Mastercards on a single, compliant platform – no more juggling banks, exchanges and card issuers.

- Fast Onboarding with personal manager

- Multi‑asset & ulti‑chain wallets with 0‑fee swaps

- SEPA / SWIFT / On‑chain payouts from one balance

Making Financial Management Simple Bright

One‑click Crypto to Fiat

Convert at institutional spreads and settle via SEPA, SWIFT or on‑chain the same day.

Multi‑chain FX

Swap assets across ERC‑20, TRC‑20, Solana, Arbitrum, BNB Chain & Tezos at institutional spreads – zero bridge fees.

Programmable Cards

Issue virtual Mastercards, set per‑card limits and automate rules via API.

Built‑in compliance

EU‑licensed custody, continuous KYT and audit‑ready exports come standard.

Built for Modern Brighty Businesses like Yours

Brighty gives modern businesses faster, more convenient onboarding processes and more up‑to‑date, flexible payment systems.

Crypto Native Businesses

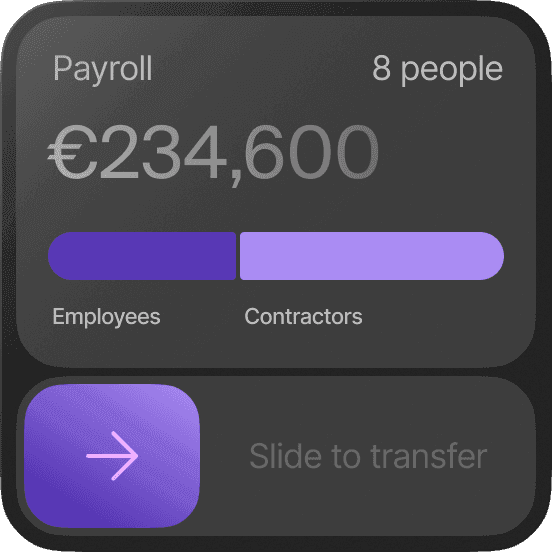

Manage treasury, convert to fiat and pay staff worldwide instantly. Get Brighty for Crypto

Agencies & Consulting

Pay suppliers, run ad spend on branded cards, settle in EUR or USDC. Get Brighty for Marketing

Global SMB & SaaS

Bill clients in crypto or EUR and automate contractor payouts. Get Brighty for SMB

Get a customized solution for your business

Tell us your flow – we'll configure accounts, APIs and card programmes to fit.

Testimonials

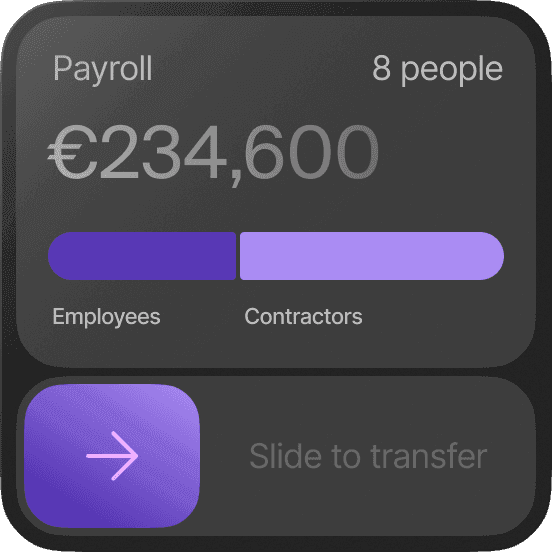

Brighty is everything your ops team needs, nothing they don’t

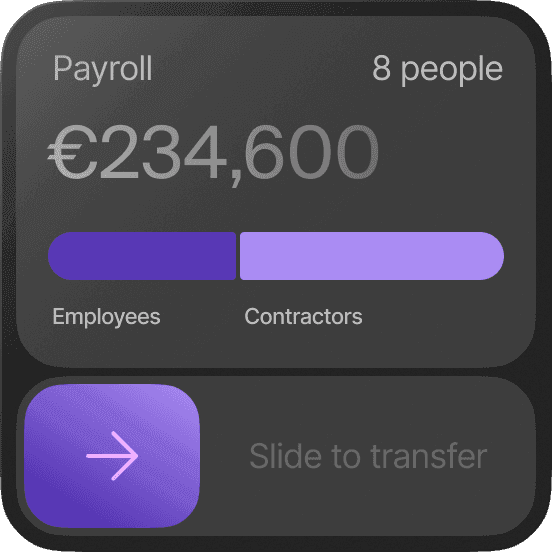

From batch payroll to instant crypto swaps, Brighty replaces four vendors with one secure platform. Multi‑chain swaps come standard – no bridge fees or hidden spreads.

Global Accessibility

Swap BTC, ETH, USDC and 20+ assets free across ERC‑20, TRC‑20, Solana, Arbitrum, BNB Chain & Tezos – then settle in EUR, GBP, USD via SEPA, SWIFT or on‑chain. One balance powers payouts and card spend worldwide.

Security and Compliance you can Trust

Frequently Asked Questions

How does Brighty Business differ from traditional banks?

How does Brighty Business differ from traditional banks?

Brighty Business is built specifically for digital businesses, offering fast onboarding, crypto-friendly services, and flexible financial operations. Unlike traditional banks, Brighty supports both fiat and crypto transactions, enabling a seamless bridge between conventional banking and digital currency ecosystems.

Who can open an account with Brighty Business?

Who can open an account with Brighty Business?

Brighty Business accounts are available to registered businesses and legal entities that meet our compliance requirements. Contact us for eligibility information.

What types of transactions can I perform with a Brighty Business account?

What types of transactions can I perform with a Brighty Business account?

You can send and receive both fiat and crypto payments, perform currency conversions, pay for services, and manage your business finances—all in one account.

Is my money safe with Brighty Business?

Is my money safe with Brighty Business?

Yes, the safety and security of your funds are a top priority for us. We implement advanced security protocols and work with regulated partners for maximum protection.

How quickly can I open an account with Brighty Business?

How quickly can I open an account with Brighty Business?

Our onboarding process is designed for speed and flexibility. In most cases, you can complete registration and open an account within a few business days, subject to verification.

How does Brighty Business handle currency conversion?

How does Brighty Business handle currency conversion?

Brighty Business enables seamless currency conversion between supported fiat and crypto currencies at competitive rates, directly from your account interface.

Have a question that still needs to be answered?

You can contact us at b2b@brighty.app