AI Investment Management

Brighty’s AI investment management platform offers:

Data-driven strategies

Data-driven strategies

You can invest in with one click

Diverse portfolios

Diverse portfolios

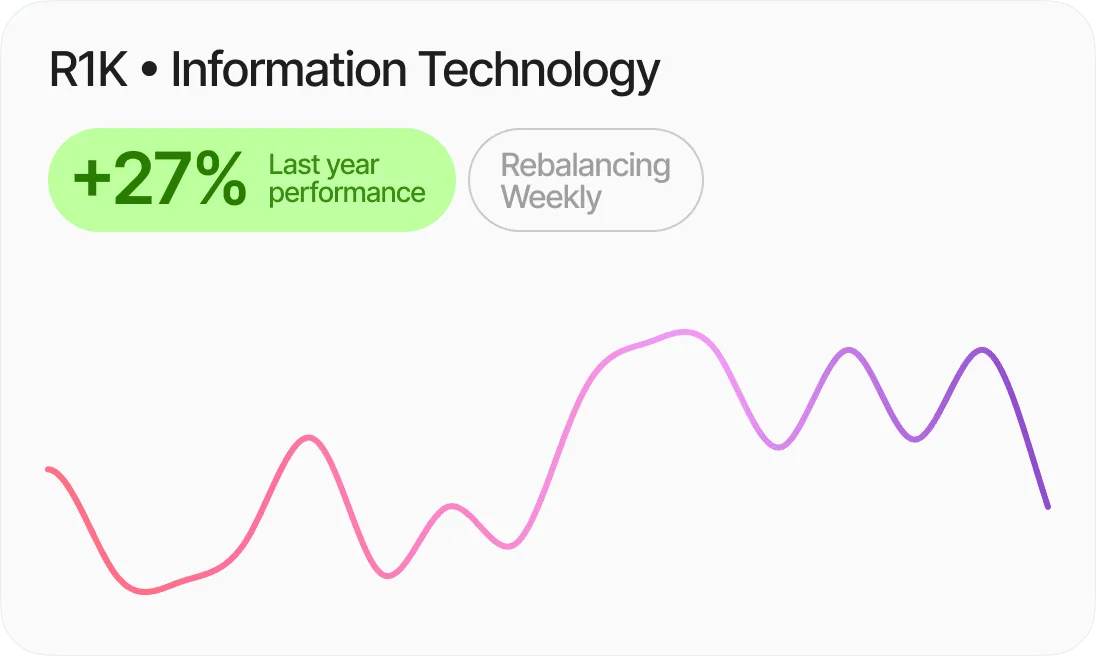

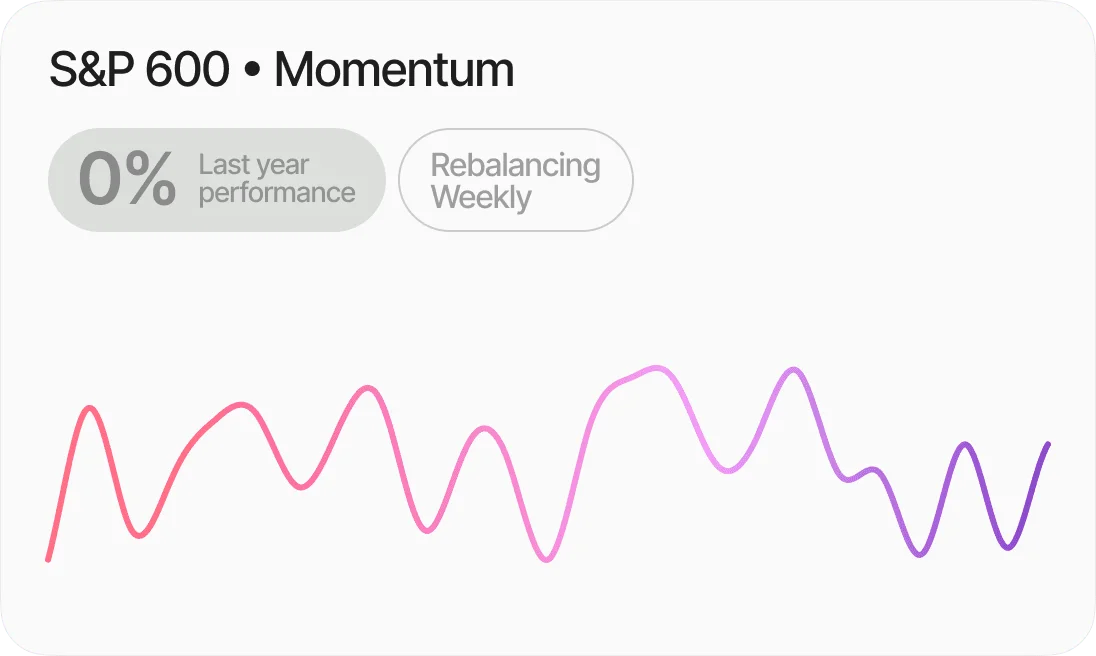

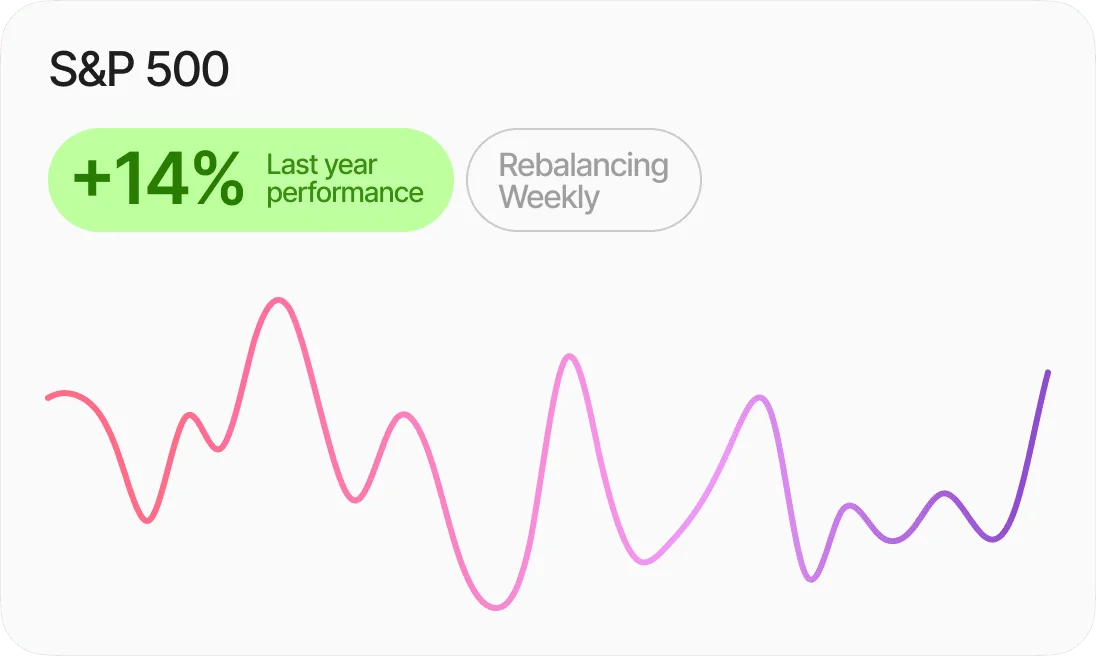

Diverse portfolios like Momentum, Industrial, Nasdaq, based on sectors S&P 500, Energy, Real Estate, and Dividends

Continuous adjustments

Continuous adjustments

Continuous monitoring and adjustments based on market trends, news, and behaviors to optimize returns

Key Features

Data-driven strategies

Choose from portfolios crafted by AI with up to 21% in the last year performance

Market Insights

AI analyzes millions of data points to create the best investment opportunities

Security and Compliance you can Trust

Licensed in the EU, audited custody with Fireblocks, continuous KYT

and proof‑of‑reserves – so you can scale without regulatory headaches.